Most hard-working, middle-class Americans aren’t aware that there are real estate investment opportunities available for just about everyone. They assume that to make a lot of money, you must have a lot of money.

Or to buy real estate, they have to buy the whole real estate and manage it themselves.

They think they have to be investment experts before they can dip their toes in the investment waters.

They think that as long as they keep investing in their IRA or 401(k), they’ll eventually get to enjoy their lives…after they retire.

But none of that is true! And this misinformation has prevented hundreds of thousands of people from living the life they dream of – now!

There are mainly two strategies for investing in commercial real estate syndications – passive and active. And, In this article we will examine how each strategy works, to help you understand the difference between passive and active real estate investing. But, First, let’s talk about what real estate syndication is and what it’s not.

Let’s understand this with the help of an example:

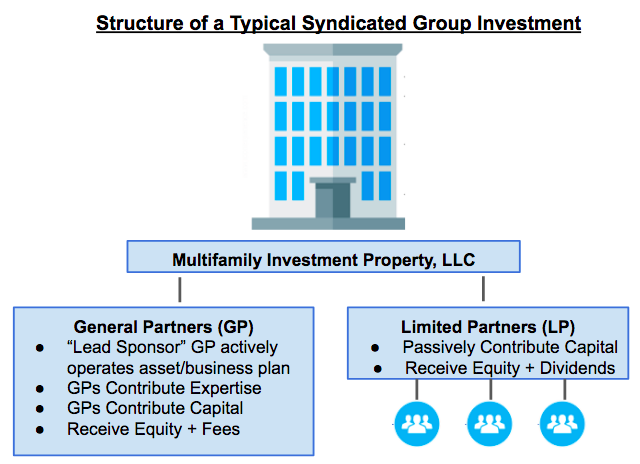

You’d invest your money, along with that of other investors with a deal sponsor. The deal sponsor would then use the funds to buy an apartment building and turn it into a source of profitable returns. As the returns flowed in, you and the other investors would receive a portion of them. This scenario is referred to as a “syndication”.

As a participant in it, your only responsibility would be to contribute an investment amount. Apart from that, everything else would be handled by the “deal sponsor”. Deal Sponsors are also called “syndicators”. In either case, they’re an active investor, doing all the hard work in a deal. They’re the ones finding a property to acquire, securing debt and cash funds to acquire it, and then managing the investments to produce returns on it for the investors.

So, technically – a real estate syndication is a group of individuals or organizations that combine their efforts to carry out a real estate investment contract.

The investment contract, in turn, is defined as any activity that involves a contract/transaction/scheme with all of the following items:

- Investment of money in a common enterprise

- The expectation of a profit

- The profit comes solely from the efforts of a deal sponsor

Now, with syndication fully defined, let’s be just as thorough in defining the deal sponsor. Moving beyond a casual definition, to understand their place in the syndication dynamic.

So you’re clear, in apartment syndication, the deal sponsor’s exact role is to do the following:

- Find a property (i.e. a deal)

- Obtain financing for the deal and manage lender relationships

- Raise capital from private individuals or business entities, as per SEC rules

- Manage the investment, as per the company’s operating agreement (the OA), and execute the business plan(s).

- Deliver tax documents such as the K1 to investors.

In addition to those items (above), the deal sponsor also communicates the details of investment offerings to private investors. This is commonly done using a document called a Private Placement Memorandum (PPM). Sometimes the PPM is called an investment prospectus. Plus, since investments and private money-raising practices are involved – the PPM and any other communication sent by the deal sponsor on investment offerings will need to follow SEC rules.

While we’re on deal sponsors, it’s worth quickly talking about another party in the syndication – the key principal.

What exactly is a key principal?

A key principal is someone who helps the deal sponsor, when the sponsor is unable to use their net worth and liquidity credentials to obtain a loan. Key principals provide additional credibility, so banks will feel comfortable providing the deal sponsor with a loan to buy an investment property. Along with credibility, key principals may also help the deal sponsor by contributing their own experience and background knowledge. Key principals may do this and/or help with the loan, to build credibility for their future deals. Another point on key principals is that banks usually require any passive investor who wants to invest a large amount (typically more than 20-25%) of the equity in a deal, to be a key principal. Since a key principal’s primary role is to be a signer in the loan, they’re given minimal ownership in the deal. Nonetheless, a key principal is still considered to be one of the general partners in the syndication, along with the deal sponsor. This designation makes key principals and deals sponsor different from the limited partners in syndication – the passive investors.

So you’re clear – passive investors are those private investors or entities that contribute capital (money) to finance a deal. They have specific roles, corresponding to three moments in the deal process.

Initially, before deciding to invest, a passive investor’s role will be the following:

- Evaluating deals that are being offered through the PPM

- Potentially using an independent security attorney to understand and review the PPM

- Communicating their intention to invest or not to invest to the deal sponsor

- Communicating the source of capital (i.e. cash, IRA, etc.)

Once they’ve decided to invest in a particular deal, a passive investor’s roles will then consist of:

- Reading, understanding, and signing the relevant investment paperwork

- Sending the money to the deal sponsor And, after the property closing, the passive investor’s role is then simply to ensure that the investment is conducted, as per the company agreement

Between the roles of an active investor (deal sponsor) versus a passive investor. The difference is that the deal sponsor is investing a considerably greater amount of their time and effort in the deal, than the passive investor.

A passive investor will spend little to no time or effort in managing the investment property. The deal sponsor, by contrast, is “all in” (i.e. at 100% in managing the property).

Join Us For A Daily 60-second Coffee Break Series For Passive Investing In Commercial Real Estate With James Kandasamy, The Best-selling Real Estate Author And Mentor.