Passive real estate investing, in general, refers to a form of investing where you earn passive income from investments – yet you aren’t personally setting up or involved in those investments. Rather, someone else – some other party you’ve entrusted – handles all aspects of the investment process for you.

The Difference between Active Vs Passive Investing

To make passive investing in commercial real estate even clearer for you – here’s an example of how it would look in practice -.

For example, you’d invest your money, along with that of other investors with a deal sponsor. The deal sponsor would then use the funds to buy an apartment building and turn it into a source of profitable returns. As the returns flowed in, you and the other investors would receive a portion of them.

This scenario is referred to as a “syndication”. As a participant in it, your only responsibility would be to contribute an investment amount. Apart from that, everything else would be handled by the “deal sponsor”. Deal Sponsors are also called “syndicators”. In either case, they’re an active investor, doing all the hard work in a deal. They’re the ones finding a property to acquire, securing debt and cash funds to acquire it, and then managing the investments to produce returns on it for the investors.

Catch the difference? Between the roles of a deal sponsor versus a passive investor. The difference is that the deal sponsor is investing a considerably greater amount of their time and effort in the deal, than the passive investor(s).

That difference stands as the primary distinction between the two investor types (deal sponsor and passive investor). A passive investor will spend little to no time or effort in managing the investment property. The deal sponsor, by contrast, is “all in” (i.e. at 100% in managing the property).

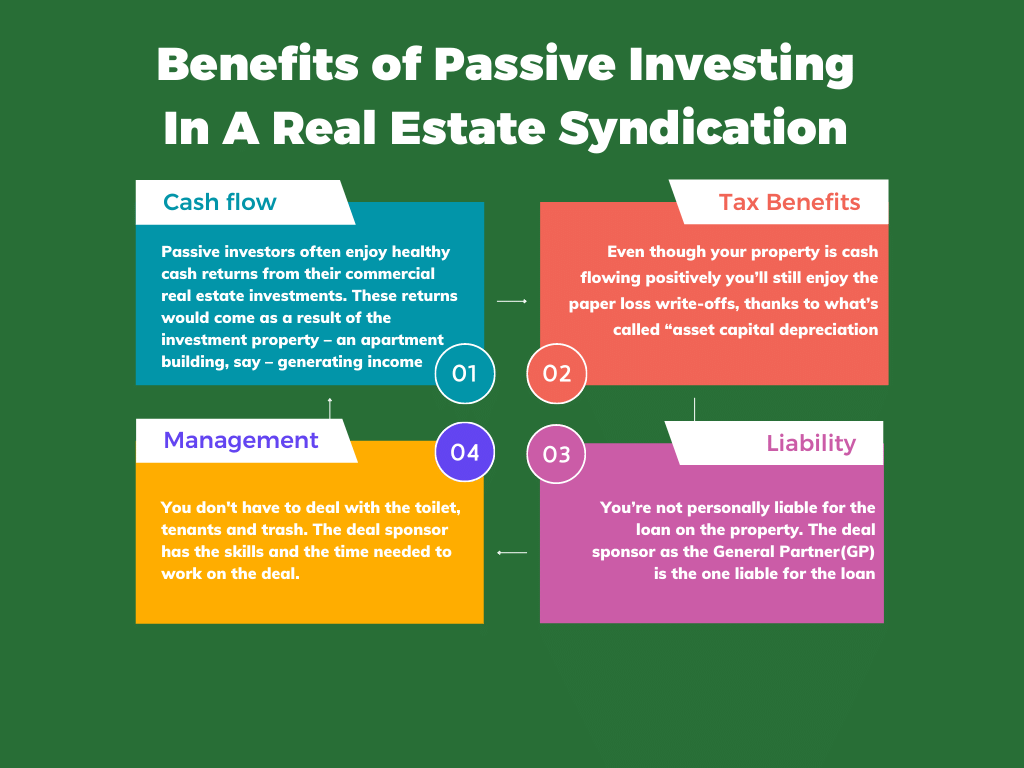

Of the two investor types, we’re focused on the passive investor. It’s the clear choice when you’re looking to invest, yet don’t want to spend any of your time on the actual investment. Beyond that, there are a host of other benefits too, for those passively investing in commercial real estate. Those benefits include – cash flow, tax benefits, loan liability exclusion, and the use of other people skills and time.

Let’s talk about the most apparent of those benefits –

- Cash flow: Passive investors often enjoy healthy cash returns from their commercial real estate investments. These returns would come as a result of the investment property – an apartment building, say – generating income. The income would be the result of tenants paying their rent and other rental-related expenses (i.e. parking, laundry, etc.). In understanding cash flow, you should recognize that your cash flow is NOT the same as the property’s income. Instead, your cash flow comes AFTER deductions have been made to the property’s income. Those deductions typically consist of the following: operating expenses (i.e. the costs of running the property); mortgage payments; and sponsor fees (i.e. the deal sponsor’s cost to actively manage the investments for the passive investors).

Once the deductions are made, the remaining amount is the money that’s available to passive investors. You’ll then receive your “cut” from this total, since it needs to be divided among the other passive investors in the deal.

What you receive as a “cut” will be your cash flow. Depending on the way the investment is structured, this cash flow may be distributed to you quarterly, annually, or even perhaps monthly.

- Personal income tax deductions: Naturally, I’m NOT a CPA or a tax attorney – so I can’t advise you on how to handle tax issues. What I can say, though, is that as a passive commercial real estate investor, you’ll be able to write off some stuff from your investments as a loss to your taxable income. Keep in mind, even though your property is cash flowing positively you’ll still enjoy the paper loss write-offs, thanks to what’s called “asset capital depreciation”.

Current tax laws allow for such depreciation through a tax form called K1. You can find more information on it, either by Googling “K1” or through browsing all the dense tax books out there.

- Leverage other people’s skills and time: You’re able to do that because there’s a deal sponsor – some person/group who’s putting the investment deal together. The deal sponsor has the skills and the time needed to work on the deal. You can leverage both of those (their skills and time) simply by investing passively in the deal. Coming along for the ride, in a sense, as the deal sponsor does the effort-intensive tasks.

- Liability: The fourth benefit of passive investing is that you’re not personally liable for the loan on the property. The deal sponsor as the General Partner(GP) is the one liable for the loan. You, the passive investor are categorized as a Limited Partner (LP) and shielded from loan liability. Plus, as a further shield, larger and specific loan products also offer non-recourse loans.

How to get started as a passive real estate investor

The way to get started is really quite simple. If you want to do passive commercial real estate investing, then your first step will be to go out and meet other people.

Meeting people is Step #1 because of what it accomplishes. Right now, if you’re like most aspiring commercial real estate investors, you’re in a “cocoon”. Not a literal cocoon, of course. But rather an intellectual cocoon – at least where your knowledge and awareness of commercial real estate investing are concerned.

In this figurative cocoon, your sense of commercial real estate investing is limited to what you’ve heard from a handful of sources or, in the worst case, only one source. Those sources would include investment groups, ads, a friend, or even a family member. Any of them may have initially exposed you to the world of real estate investing

Depending on who it was, you may have some very narrow, inaccurate or even detrimental ideas. One of those ideas is the premise that everyone who invests in real estate does well financially.

How do you solve this problem?

By getting out of your cocoon. And that happens through meeting other people.

Who exactly do you meet?

Deal sponsors. These are the folks you want to specifically meet. The reason is that deal sponsors organize passive investors to do commercial real estate investing deals. So if you find a deal sponsor, you could potentially do a deal with them.

Here now are my recommendations for finding a deal sponsor for your first commercial real estate investing deal. To find one, I recommend you check the following places:

- Local meet-ups: These are some of the best places to meet and build relationships with deal sponsors and other passive investors. You can find local meetups (i.e. informal, in-person, gatherings) through the website Meetup.com. Simply log on (visiting Meetup.com) and search for commercial real estate investing topics such as “Apartment Investing”. Your search will then reveal various local meet-ups for you to attend.

- Local Investment Clubs: Along with meetups, local investment clubs are another worthwhile place to find deal sponsors. As we said earlier, you don’t want a single investment club to be your ONLY source for learning and engaging in real estate investing. But assuming that’s not the case and you have multiple sources, then clubs can be a great way to meet other people. If you do participate in a local investment club, you’ll probably find it similar to what’s on Meetup.com. The similarities are strong, at least with clubs on the local level.

- Real estate social media: We’re referring here to any of the large online communities for real estate investors. The best one by far, is BiggerPockets (BiggerPockets.com). On this site, you can create a free account to use in asking questions and connecting with deal sponsors. Make sure to look in the commercial real estate or Apartment/Multifamily investing forums. Those are the places on BiggerPockets where most of the deal sponsors for apartment investing tend to be active. Find the deal sponsors and then build relationships with them by networking through the BiggerPockets website.

Join Us For A Daily 60-second Coffee Break Series For Passive Investing In Commercial Real Estate With James Kandasamy, The Best-selling Real Estate Author And Mentor.